In order for the IRS to verify that individuals and employers are meeting their shared responsibility obligations, and that individuals who request premium tax credits are entitled to them, employers and insurers will be required to provide reporting on the health coverage they offer. Reporting will first be due early in 2016, based on coverage in 2015.

In order for the IRS to verify that individuals and employers are meeting their shared responsibility obligations, and that individuals who request premium tax credits are entitled to them, employers and insurers will be required to provide reporting on the health coverage they offer. Reporting will first be due early in 2016, based on coverage in 2015.

On July 24, 2014, the IRS published drafts of several of the forms that will be used to provide the required reporting. Instructions were not released with the draft forms, so some questions remain unanswered. The IRS has said that it will issue drafts of the instructions in August and that the final forms and instructions will be available by the end of 2014.

Generally speaking, an employer will not have any reporting requirement if it has fewer than 50 full-time and full-time equivalent employees in its controlled group and it sponsors a fully insured medical plan. All other employers will have at least some reporting. This appears to include employers with 50 to 99 employees for 2015 – even though the employer-shared responsibility requirement has been delayed until 2016 for most employers in this group, reporting is still needed to help determine whether individual employees owe penalties or are eligible for premium subsidies.

Employers with 50 or more full-time or full-time equivalent employees in their controlled group – whether the coverage offered is fully insured or self-funded – will need to complete both Part I and Part II of IRS Form 1095-C. This form will be required for each employee, regardless of whether the employee is eligible for medical coverage. Part I includes basic identifying information. Part II will be used to determine whether minimum essential, minimum value and affordable coverage was offered and accepted. This data will be used to determine whether the employer owes penalties for not offering minimum essential coverage (these are sometimes referred as the “A” penalty or the $2,000 penalty) or for not offering affordable, minimum value coverage (these are sometimes referred to as the “B” penalty or the $3,000 penalty) and if the employee is eligible for premium subsidies.

The employer will use one of several codes to report whether it offered coverage to the employee, and the extent of the coverage it offered. The employer also will report the employee’s share of the lowest cost monthly premium for self-only minimum value coverage for which the employee is eligible.

Finally, the employer will enter codes that the IRS will use when determining if a penalty is owed. Those codes address whether the employee was eligible for coverage during the month, including whether the employee was employed, classified as full-time, in a waiting period or covered. If the employee was covered during the month, the employer will report whether coverage was affordable and which affordability safe harbor was used.

In addition, employers with self-funded plans will complete Part III of Form 1095-C. Part III information will be used to determine whether the employee’s family met its requirement to have minimum essential coverage.

Information that is similar to the information provided on Part III of Form 1095-C will be provided by the insurer to the employee using IRS Form 1095-B. Form 1095-B will report whether the employee and the employee’s spouse and children had minimum essential coverage for each month. This means that an employee who works for a mid-size or large employer that provides coverage on a fully insured basis will receive two forms: Form 1095-B from the insurer and Form 1095-C from the employer.

Employers with 50 full-time and full-time equivalent employees in their controlled group also will need to file IRS Form 1094-C, with a copy of the Form 1095-C it issued to each employee. Employers that are part of a controlled or affiliated service group also must enter the name and EIN of all other employers that were part of the group during the calendar year. Each employer in a controlled or affiliated service group must file a separate report, although one member of the controlled group may complete the form on behalf of other members. In certain circumstances, government plans may report on a single form through a “designated government entity.”

The reporting will occur with the same timing and process as W-2 and W-3 reporting. Even though these forms are not final, employers may want to study them as they begin to determine whether they are currently collecting, and will be able to retrieve, the information needed to complete the forms.

For a summary of the draft IRS employer and insurer reporting forms, download UBA’s PPACA Advisor, “IRS Issues Drafts of Individual and Employer Responsibility Reporting Forms.”

In order for the IRS to verify that individuals and employers are meeting their shared responsibility obligations, and that individuals who request premium tax credits are entitled to them, employers and insurers will be required to provide reporting on the health coverage they offer. Reporting will first be due early in 2016, based on coverage in 2015.

In order for the IRS to verify that individuals and employers are meeting their shared responsibility obligations, and that individuals who request premium tax credits are entitled to them, employers and insurers will be required to provide reporting on the health coverage they offer. Reporting will first be due early in 2016, based on coverage in 2015.

A more meaningful attempt to manage absences can go a long way toward helping ease the staffing and morale challenges of small and midsize businesses that often feel the impact of absences more acutely than larger firms. What’s more, in an environment where government oversight is only intensifying, effective absence management may become more challenging and burdensome for employers unless they have access to a specialist who understands the increasing and ever-changing federal, state and local Family and Medical Leave Act (FMLA) laws. The Americans with Disabilities Act (ADA) also needs to be considered. For example, requirements have expanded in recent years to include reasonable accommodations designed to reduce employee stress, which can trigger absences and erode productivity.

A more meaningful attempt to manage absences can go a long way toward helping ease the staffing and morale challenges of small and midsize businesses that often feel the impact of absences more acutely than larger firms. What’s more, in an environment where government oversight is only intensifying, effective absence management may become more challenging and burdensome for employers unless they have access to a specialist who understands the increasing and ever-changing federal, state and local Family and Medical Leave Act (FMLA) laws. The Americans with Disabilities Act (ADA) also needs to be considered. For example, requirements have expanded in recent years to include reasonable accommodations designed to reduce employee stress, which can trigger absences and erode productivity.

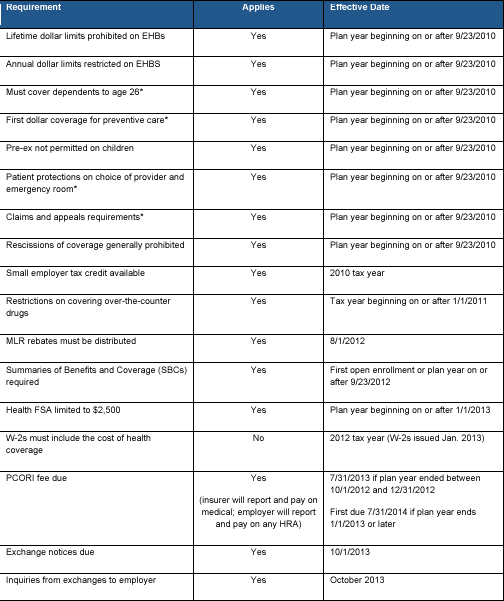

Provisions Effective 2010 – 2013

Provisions Effective 2010 – 2013